Questions Remain as Gov. Pillen Doubles Down on Taking Over K-12 Public School Funding

Source: https://nebraskaexaminer.com/

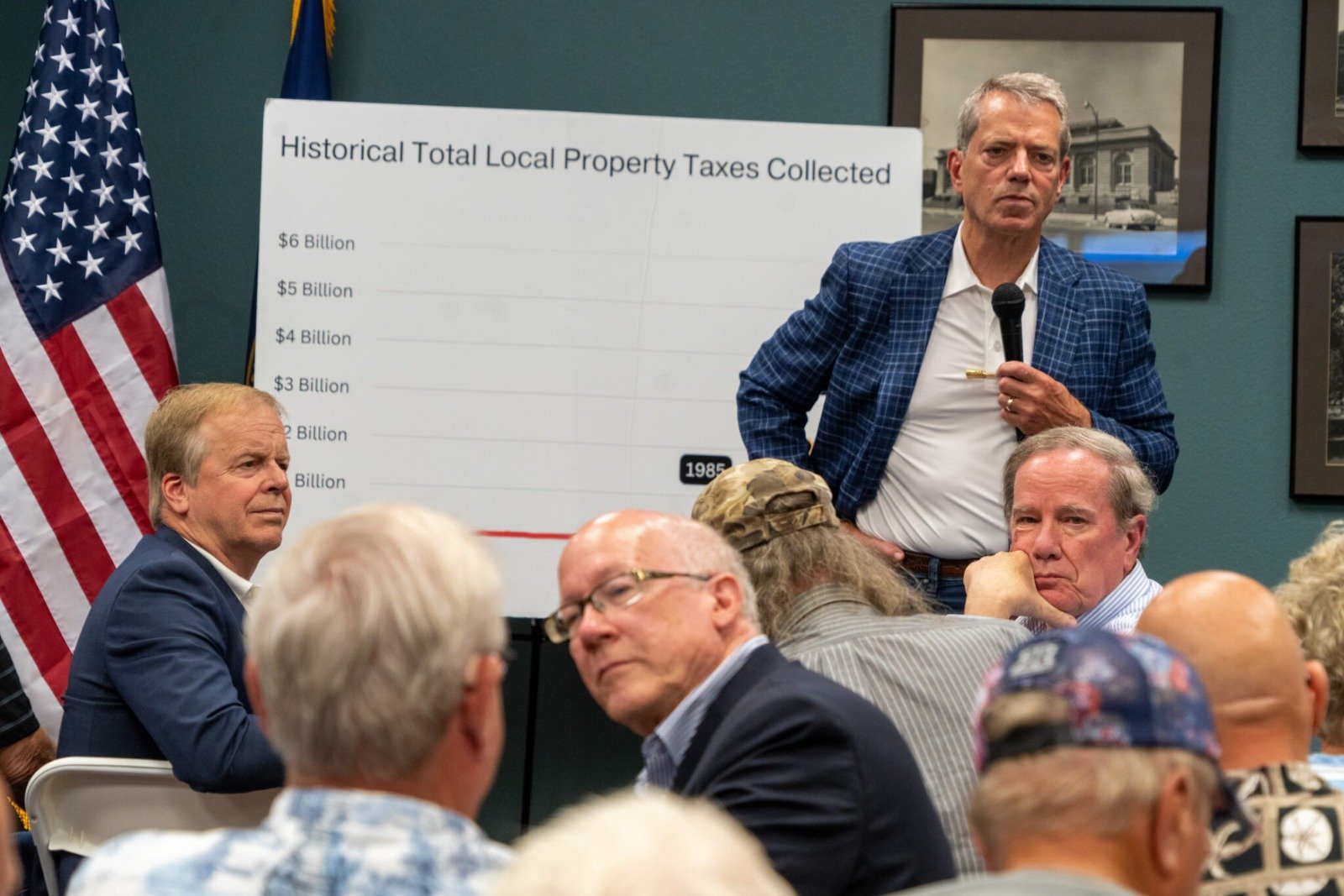

Governor Jim Pillen of Nebraska announced plans to shift K-12 school funding away from local property taxes, proposing that the state take on an additional $1.65 billion in funding. This initiative, discussed in a town hall in Columbus, aims to centralize school finance at the state level, similar to funding models for community colleges.

Key Highlight:

-Pillen’s proposal includes capping local political subdivisions’ spending increases and aims to streamline school funding processes while addressing concerns about local control and funding stability. Pillen also discussed potential changes to sales tax exemptions and opposition to legalizing recreational marijuana as additional revenue sources.

-Ryan Loseke, a former member of the Lakeview Community Schools board, expressed concerns that Governor Jim Pillen’s proposal to centralize K-12 school funding would diminish local control across Nebraska’s 244 public school districts, each with its distinct culture and priorities. Loseke suggested he would prefer a model involving foundation aid.

-Governor Jim Pillen drew parallels between his proposed shift in K-12 school funding and recent changes in community college financing, where legislation in 2023 transferred funding responsibility from property taxes to state funds, while allowing a limited return to property taxes if necessary.

-Regarding school funding, Nebraska allocated about 60% of its $5.3 billion property tax revenue to K-12 education for the 2022-23 school year, comprising $2.8 billion in direct taxes and $318 million in bonds. Property taxes accounted for approximately 48% of total school revenue sources in Nebraska during the 2020-21 academic year, with an average of 36% across all states.

-Governor Jim Pillen’s proposed education funding overhaul, set for discussion in a special session starting July 25, aims to centralize most school funding under the Legislature’s control, with Pillen wielding the line-item veto power. He asserts that this model will enhance educational outcomes while addressing concerns about unfunded mandates, including staff training requirements.

-Pillen advocates for implementing hard spending caps to simplify the state aid formula, potentially allowing schools to allocate resources towards higher teacher salaries and fewer administrative positions. However, details on specific spending freezes or how schools would request budget increases remain unclear.

-Despite these uncertainties, Pillen emphasizes that funding education is a top priority for Nebraskans, highlighting recent fluctuations in statewide school tax revenues as indicative of ongoing financial challenges for school districts.

-State Senator Jana Hughes of Seward supports increased state financial support for schools and advocates for modernizing Nebraska’s tax code to include taxes on more services, reflecting a shift from goods-based to service-dominated economy. She hopes to incrementally achieve sustainable funding for 100% of school expenses and would be pleased with an additional $1 billion in funding from the upcoming special session.

Image Source: https://nebraskaexaminer.com/